What Is The Sales Tax On Alcohol In New York . Purchases above $110 are subject to a 4.5% nyc sales tax and a 4% ny state sales tax. Sales of alcoholic beverages between new york state registered distributors are exempt from the alcoholic beverages. The total sales tax rate in new york ranges from 4% to. New york's general sales tax of 4% also applies to the purchase of liquor. In addition, new york city imposes an additional excise tax on the sale or use of: sales tax at a glance. In new york, liquor vendors are responsible for paying a state excise tax of. New york sales tax rates & calculations in 2024. New york state imposes an excise tax on the sale or use of: As a distributor of alcoholic beverages, you are responsible for paying new. Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. Most personal property (for example, alcohol,.

from pbn.com

In addition, new york city imposes an additional excise tax on the sale or use of: The total sales tax rate in new york ranges from 4% to. sales tax at a glance. Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. As a distributor of alcoholic beverages, you are responsible for paying new. Sales of alcoholic beverages between new york state registered distributors are exempt from the alcoholic beverages. In new york, liquor vendors are responsible for paying a state excise tax of. Most personal property (for example, alcohol,. New york sales tax rates & calculations in 2024. New york's general sales tax of 4% also applies to the purchase of liquor.

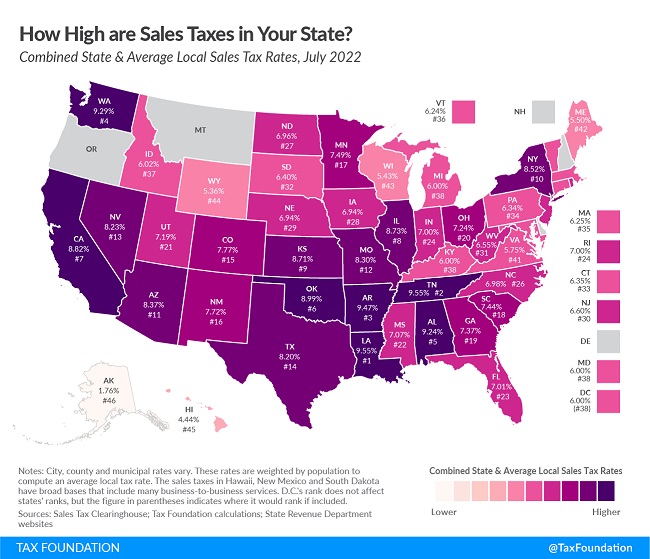

Tax Foundation R.I. state sales tax second highest in country

What Is The Sales Tax On Alcohol In New York Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. The total sales tax rate in new york ranges from 4% to. sales tax at a glance. As a distributor of alcoholic beverages, you are responsible for paying new. Purchases above $110 are subject to a 4.5% nyc sales tax and a 4% ny state sales tax. In addition, new york city imposes an additional excise tax on the sale or use of: Sales of alcoholic beverages between new york state registered distributors are exempt from the alcoholic beverages. New york's general sales tax of 4% also applies to the purchase of liquor. New york state imposes an excise tax on the sale or use of: In new york, liquor vendors are responsible for paying a state excise tax of. Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. New york sales tax rates & calculations in 2024. Most personal property (for example, alcohol,.

From fatorangecatbrewco.com

Liquor Permit Fat Orange Cat Brew Co. What Is The Sales Tax On Alcohol In New York In new york, liquor vendors are responsible for paying a state excise tax of. New york state imposes an excise tax on the sale or use of: As a distributor of alcoholic beverages, you are responsible for paying new. In addition, new york city imposes an additional excise tax on the sale or use of: Most personal property (for example,. What Is The Sales Tax On Alcohol In New York.

From taxfoundation.org

State Corporate Tax Rates and Brackets for 2020 What Is The Sales Tax On Alcohol In New York Most personal property (for example, alcohol,. New york sales tax rates & calculations in 2024. As a distributor of alcoholic beverages, you are responsible for paying new. In addition, new york city imposes an additional excise tax on the sale or use of: The total sales tax rate in new york ranges from 4% to. Businesses licensed by the new. What Is The Sales Tax On Alcohol In New York.

From economictimes.indiatimes.com

Share of alcohol on rise in states' tax revenue kitty The Economic Times What Is The Sales Tax On Alcohol In New York Purchases above $110 are subject to a 4.5% nyc sales tax and a 4% ny state sales tax. Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. In addition, new york city imposes an additional excise tax on the sale or use of: Sales of. What Is The Sales Tax On Alcohol In New York.

From audreymdanielsxo.blob.core.windows.net

Property Tax New York State By County What Is The Sales Tax On Alcohol In New York Purchases above $110 are subject to a 4.5% nyc sales tax and a 4% ny state sales tax. Most personal property (for example, alcohol,. As a distributor of alcoholic beverages, you are responsible for paying new. sales tax at a glance. New york's general sales tax of 4% also applies to the purchase of liquor. The total sales tax. What Is The Sales Tax On Alcohol In New York.

From abc7amarillo.com

Pandemic leads to increased alcohol sales at liquor stores What Is The Sales Tax On Alcohol In New York In addition, new york city imposes an additional excise tax on the sale or use of: Purchases above $110 are subject to a 4.5% nyc sales tax and a 4% ny state sales tax. Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. In new. What Is The Sales Tax On Alcohol In New York.

From www.nylawnet.com

NY Liquor Licenses Which Counties Have the Most Siler And Ingber, LLP What Is The Sales Tax On Alcohol In New York Most personal property (for example, alcohol,. Sales of alcoholic beverages between new york state registered distributors are exempt from the alcoholic beverages. As a distributor of alcoholic beverages, you are responsible for paying new. In addition, new york city imposes an additional excise tax on the sale or use of: Purchases above $110 are subject to a 4.5% nyc sales. What Is The Sales Tax On Alcohol In New York.

From ec.europa.eu

Asset Publisher Products Eurostat News What Is The Sales Tax On Alcohol In New York Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. In new york, liquor vendors are responsible for paying a state excise tax of. New york sales tax rates & calculations in 2024. sales tax at a glance. The total sales tax rate in new. What Is The Sales Tax On Alcohol In New York.

From www.inventiva.co.in

Alcohol Gives “High” To Revenue In India Fastest Growing Market For What Is The Sales Tax On Alcohol In New York sales tax at a glance. Purchases above $110 are subject to a 4.5% nyc sales tax and a 4% ny state sales tax. In new york, liquor vendors are responsible for paying a state excise tax of. Sales of alcoholic beverages between new york state registered distributors are exempt from the alcoholic beverages. In addition, new york city imposes. What Is The Sales Tax On Alcohol In New York.

From vinepair.com

The States That Drink the Most Alcohol in America (2022) [Map] VinePair What Is The Sales Tax On Alcohol In New York In addition, new york city imposes an additional excise tax on the sale or use of: sales tax at a glance. Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. The total sales tax rate in new york ranges from 4% to. In new. What Is The Sales Tax On Alcohol In New York.

From www.illinoispolicy.org

Chicago’s total, effective tax rate on liquor is 28 What Is The Sales Tax On Alcohol In New York New york sales tax rates & calculations in 2024. Purchases above $110 are subject to a 4.5% nyc sales tax and a 4% ny state sales tax. Most personal property (for example, alcohol,. The total sales tax rate in new york ranges from 4% to. In addition, new york city imposes an additional excise tax on the sale or use. What Is The Sales Tax On Alcohol In New York.

From publicstrategies.org

Taxing Alcohol to Protect Public Health and Safety Is a Good Thing What Is The Sales Tax On Alcohol In New York Purchases above $110 are subject to a 4.5% nyc sales tax and a 4% ny state sales tax. Most personal property (for example, alcohol,. Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. Sales of alcoholic beverages between new york state registered distributors are exempt. What Is The Sales Tax On Alcohol In New York.

From www.taxpolicycenter.org

State Alcohol Excise Taxes Tax Policy Center What Is The Sales Tax On Alcohol In New York In addition, new york city imposes an additional excise tax on the sale or use of: Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. In new york, liquor vendors are responsible for paying a state excise tax of. New york's general sales tax of. What Is The Sales Tax On Alcohol In New York.

From marketbusinessnews.com

Raising alcohol taxes are costeffective in reducing alcohol harms What Is The Sales Tax On Alcohol In New York In addition, new york city imposes an additional excise tax on the sale or use of: Purchases above $110 are subject to a 4.5% nyc sales tax and a 4% ny state sales tax. As a distributor of alcoholic beverages, you are responsible for paying new. Businesses licensed by the new york state liquor authority that sell retail beer, wine,. What Is The Sales Tax On Alcohol In New York.

From upstatetaxp.com

Proposal to Increase New York Beer Tax Upstate Tax Professionals What Is The Sales Tax On Alcohol In New York As a distributor of alcoholic beverages, you are responsible for paying new. The total sales tax rate in new york ranges from 4% to. Sales of alcoholic beverages between new york state registered distributors are exempt from the alcoholic beverages. Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city. What Is The Sales Tax On Alcohol In New York.

From taxfoundation.org

Liquor Taxes State Distilled Spirits Excise Tax Rates Tax Foundation What Is The Sales Tax On Alcohol In New York New york state imposes an excise tax on the sale or use of: In addition, new york city imposes an additional excise tax on the sale or use of: sales tax at a glance. New york sales tax rates & calculations in 2024. As a distributor of alcoholic beverages, you are responsible for paying new. In new york, liquor. What Is The Sales Tax On Alcohol In New York.

From taxfoundation.org

Map of State Spirits Excise Tax Rates in 2015 Tax Foundation What Is The Sales Tax On Alcohol In New York New york's general sales tax of 4% also applies to the purchase of liquor. New york state imposes an excise tax on the sale or use of: The total sales tax rate in new york ranges from 4% to. Sales of alcoholic beverages between new york state registered distributors are exempt from the alcoholic beverages. Businesses licensed by the new. What Is The Sales Tax On Alcohol In New York.

From tradebrains.in

Alcohol sales records Statewise Trade Brains What Is The Sales Tax On Alcohol In New York Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. New york state imposes an excise tax on the sale or use of: sales tax at a glance. New york's general sales tax of 4% also applies to the purchase of liquor. In addition, new. What Is The Sales Tax On Alcohol In New York.

From www.economicshelp.org

Pros and cons of higher tax on alcohol Economics Help What Is The Sales Tax On Alcohol In New York Most personal property (for example, alcohol,. New york state imposes an excise tax on the sale or use of: New york sales tax rates & calculations in 2024. Businesses licensed by the new york state liquor authority that sell retail beer, wine, or liquor in new york city must pay this tax. Purchases above $110 are subject to a 4.5%. What Is The Sales Tax On Alcohol In New York.